Introduction

As the year sprints towards the finish line, dentists aren't just checking their patients' smiles; they're also eyeing their practice's financial overhead. One crucial cavity to fill in their financial planning is understanding Section 179 of the tax code to give their practice a leg up in the New Year.

Understanding Section 179 Deductions: It’s Like Flossing for Finances

Section 179 isn't just a boring tax code section; it's the magic wand for businesses, including our beloved dental practices, letting them magically deduct the full price of that shiny new equipment from their tax dues. It's like the reward for investing in yourself—a financial high-five from the IRS.

The Year-End Dash: 'Tis the Season for Tax Savings

Ah, December 31st, the date when procrastinators panic about resolutions and dentists scramble to bag those deductions. Getting those dental chairs, digital imaging systems, and snazzy tools before the year’s end can make a serious dent in taxable income, bringing in those jolly savings.

The Urgency for Dental Equipment Purchases: Because Cavemen Dentistry Went Extinct for a Reason

Upgrading equipment isn't just about dazzling the competition; it's about giving patients top-notch care. From 3D scanners to gadgets that make root canals feel like a spa day, it’s about ensuring patients leave your office thinking, "Wow, that wasn’t as terrifying as I thought!"

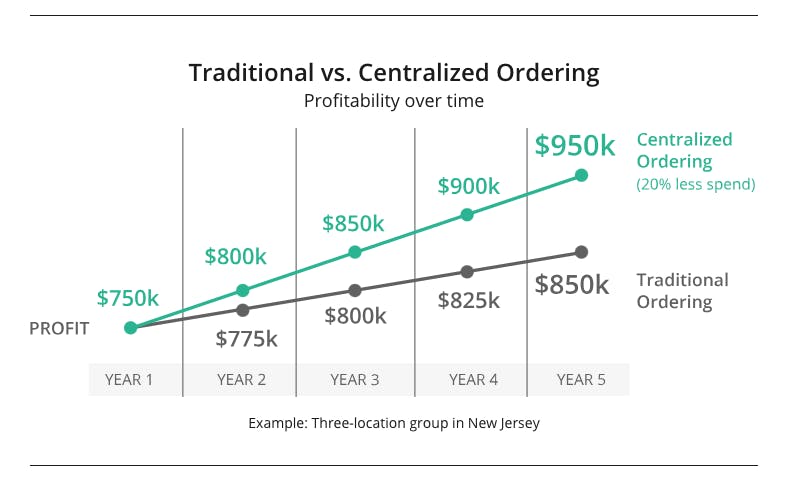

Leveraging Tax Benefits: Making Numbers Work Harder Than a Tooth Fairy

Picture this: a dental practice splurges $50,000 on new gear before the year's curtain call. Thanks to Section 179, that whole amount can magically vanish from the taxable income. In a 35% tax bracket, that’s like a money-saving spell of $17,500. Abracadabra, that's some serious magic!

Timing is Key: It’s All About Last-Minute Shopping (for Equipment)

Remember, it's not just about throwing money around; it's about getting those gadgets working before the clock strikes midnight on December 31st. So, whip out that calendar and plan those purchases like you're plotting a heist (but a lawful, tax-saving one).

Strategic Financial Planning: Making Your Practice Sparkle, Inside and Out

Upgrading gear isn't just a tax gig; it’s about wowing patients with your tech prowess. Think smoother procedures, fancier diagnostic tools, and patients who leave thinking, "That was quick, painless, and oddly impressive."

Consultation and Planning: Don’t Be a Lone Ranger in the Tax Wild West

Sure, Section 179 is a financial wizardry, but talking to those tax whizzes and financial gurus is like having a GPS for your savings. They’ll navigate the tax labyrinth while you focus on what you do best—brightening up those smiles.

Conclusion: The Countdown Begins—Magic and Savings Await!

In summary, it's not just about upgrading equipment; it’s about turbo-charging your practice. Roll up those sleeves, dive into the tech pool, and let Section 179 sprinkle some financial fairy dust on your year-end checklist.